Lloyds Bank

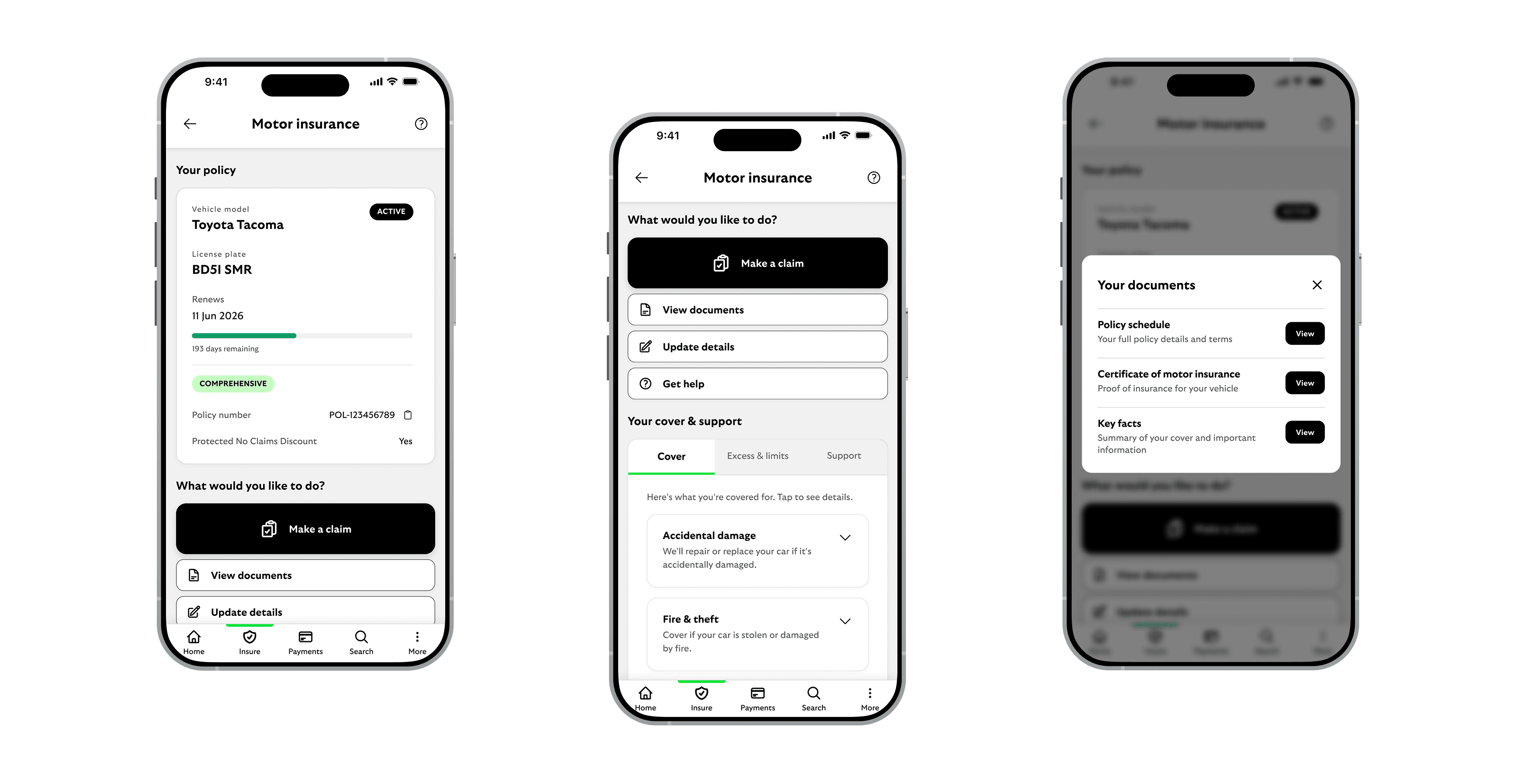

I designed a mobile Product Detail Page (PDP) for an active Motor Insurance policy within the Lloyds Bank app. The goal was to help customers quickly understand their cover, access key actions, and feel supported during stressful moments, especially when making a claim.

UX/UI Designer

Figma and Adobe Creative Suite

The Challenge

Motor insurance screens are usually visited during uncertainty or stress.

The experience needed to:

Reassure customers about their policy

Make urgent actions extremely obvious

Keep complex information readable and manageable

Fit naturally into Lloyds’ existing mobile patterns

Approach

I designed the PDP as a service-first experience, grounded in clarity, calmness, and familiarity.

The structure answers three simple user questions:

What’s my situation? (policy summary card)

What can I do? (action buttons + modals)

What am I covered for? (cover details, excesses, support)

I used Lloyds’ design language, monochrome base, bright green accents, rounded cards — to create a trustworthy and consistent UI.

Solution Highlights

Summary Card

Key details at a glance: vehicle, policy status, renewal date, cover type, and NCD.

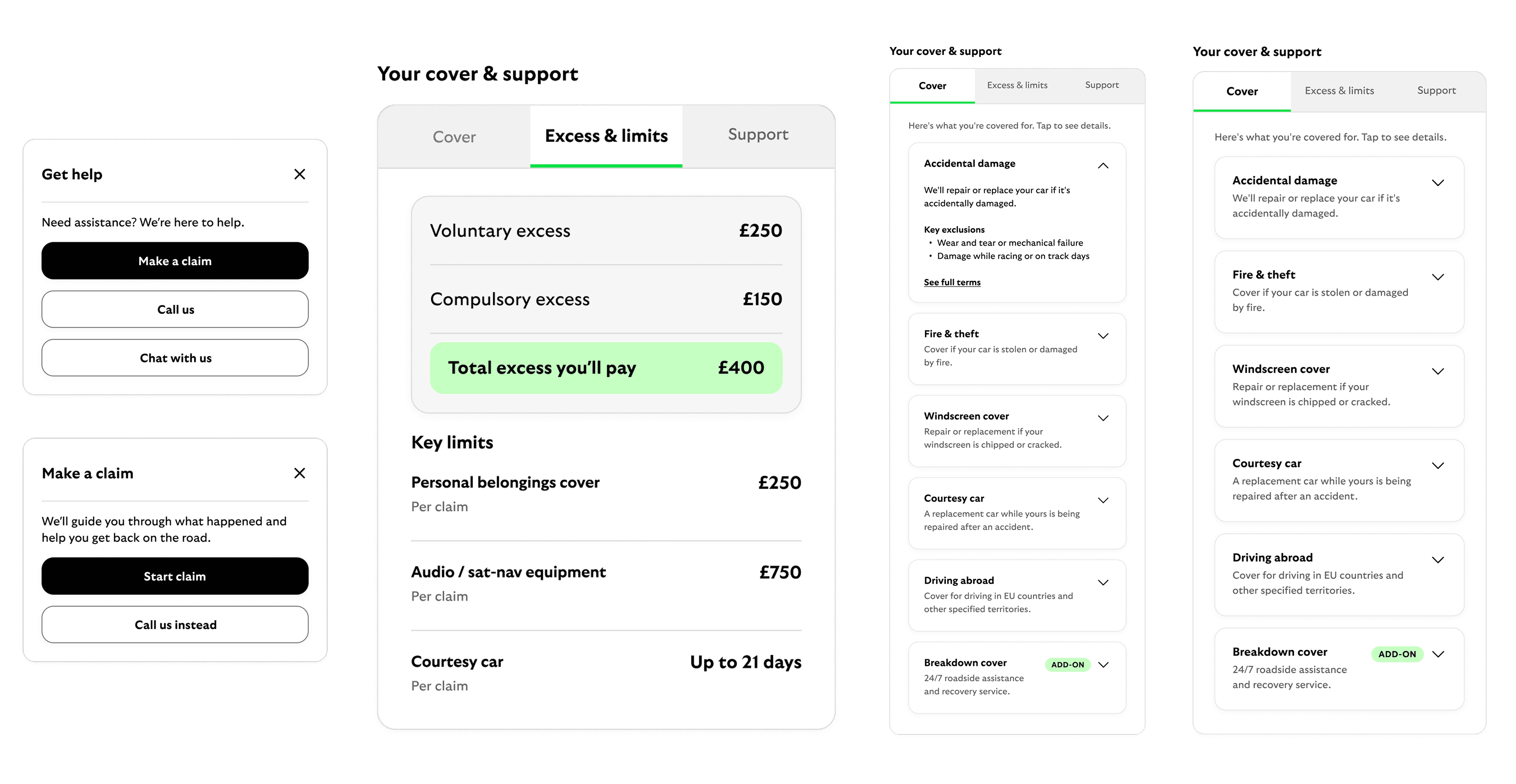

Action Section

Primary: Make a claim

Secondary: View documents, update details, get help.

Each secondary action opens a modal, keeping users anchored in the PDP.

Detailed Cover & Support

Tabs for Cover, Excess & Limits, and Support.

Expandable accordions reduce cognitive load.

Clear emphasis on total excess and emergency support.

Claim Flow

Designed a guided 6-step claim journey with a stepper, simple questions, review screen, and confirmation.

Scalability

The layout is product-agnostic.

The same framework — Summary → Actions → Details → Support — can be applied across:

Investments

Pensions

Home insurance

Loans / credit products

And the components (cards, tabs, accordions, modals) are fully reusable across Lloyds’ ecosystem.

Process

Discover: Reviewed Lloyds app, studied competitor insurance flows, identified customer needs.

Define: Prioritised reassurance, clarity, fast access to actions.

Develop: Explored layouts, built components, designed claim flow, prototyped interactions.

Deliver: High-fidelity screens, Auto Layout, variants, full prototype, and a live coded demo.

Outcome

A clear, supportive, and action-first PDP that:

Helps customers feel confident in urgent moments

Makes claims and documents easy to find

Scales seamlessly to other Lloyds products

Aligns with brand and accessibility standards